As the new school year approaches, parents around the country are starting to worry about how they will afford to send their children back to school. The cost of supplies and clothes can add up quickly – but with a little bit of planning and creativity, it’s possible to save money on back-to-school expenses.

25

Jul

Three Tips On How To Begin A Garden On A Budget!

These Three Tips Are How To Begin A Garden On A Budget! It’s the summer season and gardens everywhere are looking bright – but are you worried about the potential high costs of embracing your green thumb? Many people think that in order to have a beautiful garden, they need to spend a lot of

16

Jun

Apply These 3 Easy Methods To Drastically Cut Costs On Your Kitchen Expenses

When you’re working on revamping your budget, there are some areas that have a little more wiggleroom than others – such as the kitchen. There are tons of little tricks that add up by the end of each week, month, and year! We’ll show you three easy methods that will help you slash your costs

25

May

Enjoying A Great Summer While Keeping Cost Low With These Three Tips!

It’s no secret that the summertime can be a costly season. Between vacations, entertainment, and extra utility bills, the expenses can quickly add up. However, there are many ways to enjoy the summer without breaking the bank. In this article, we will explore three easy methods for keeping your summer filled with fun while keeping

26

Apr

Tips for Teens to Help Save Money

Helping Your Teens Learn How To Save With These Three Tips As a parent, ensuring your children have been taught effective financial skills can seem like a daunting task. Entering high school, most of the talks regarding money have only been in small and sporadic amounts (such as fees for school trips or received

15

Mar

Top 3 Tips To Help Set Your Kids Up For Financial Success

These Top Three Tips Will Help Set Your Kids Up For Financial Success When we were growing up, financial literacy was often a mixed bag throughout our peer groups. Through the last couple years, we’ve all collectively seen plenty who have successfully weathered the storm in addition to unfortunate stories of financial situations gone

15

Feb

Taking Advantage of THIS Tax Credit to Improve Property Value While on Vacation in 2022!

Taking Advantage of THIS Tax Credit to Improve Property Value While on Vacation in 2022! Spring is quickly approaching, and with the warming of the weather comes the desire to spread our wings and fly somewhere even warmer. Though, put aside those feelings that you need to leave the Georgian Bay area, as there is

09

Jan

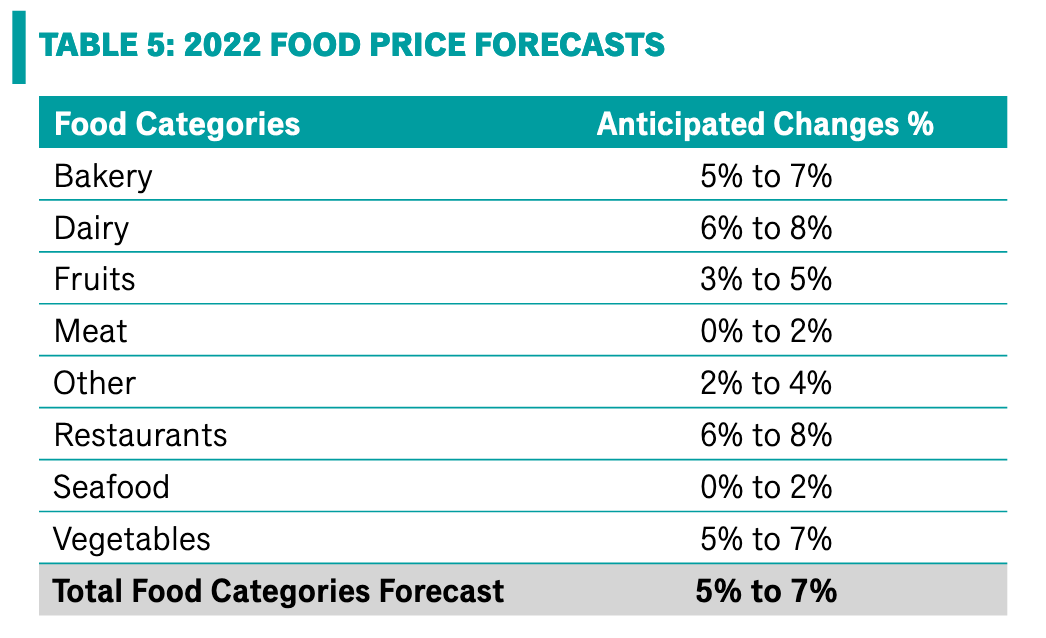

Inflation 2022: Bracing Yourself for the Rising Costs of Food

Inflation 2022: Bracing Yourself for the Rising Costs of Food As we all bundled ourselves in for the holiday season, our plates filled with delicious comfort food after such a long, exhausting year, it felt a little daunting to peek into what the future will look like – especially when it came to what was

20

Oct

When Does My Small Business Need to Start Collecting HST?

As a small business owner, do you know when your business should start collecting HST? The Canadian Revenue Agency (CRA) states that you have to register for an HST account if: You make taxable sales, leases, or other supplies in Canada And you are not a small supplier This could be confusing, especially

Tips to Start and Grow Your Small Business

Congratulations! You have decided to start a new business venture or are planning to grow your existing small business. This can be a daunting task but with the recent pandemic, many people have been moving away from their previous careers and are looking at being their own boss. We have put together some tips to

Recent Comments