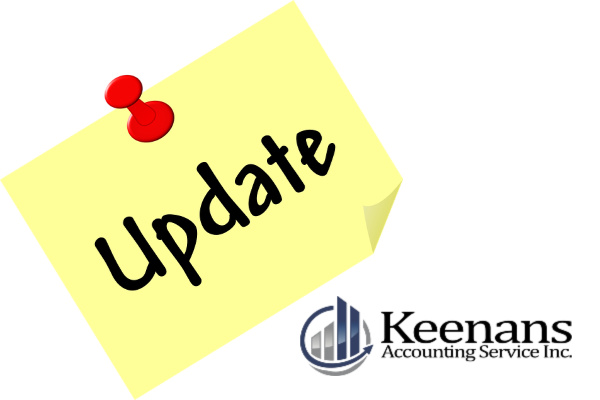

As tax season draws to a close, many individuals and businesses face the last-minute decision between using tax software or consulting with a tax preparation professional. While tax software can be convenient, there are significant advantages to working with a professional who can make a substantial difference in your financial outcomes. Professional Insight and

18

Feb

How to Maximize Your Tax Return

It’s the least wonderful time of the year – tax time! That seems to be most people’s feelings towards getting through their annual tax return. In addition, there is usually some concern about what is tax relevant and what is not, and exactly what paperwork is needed. Taken together, this usually results in a higher

12

Feb

Navigating Tax Season in Ontario: The Advantages of Professional Tax Services

As tax season unfolds in Ontario, individuals and those who are self-employed or running sole proprietorships face the annual task of tax preparation. While the allure of DIY tax software is strong, the benefits of engaging with a professional tax service like Keenans Accounting Service are significant and worth considering. Navigating the Maze of Tax

27

Jan

Top 3 Changes To Canada’s Tax System You Need To Know For 2023

The landscape of properly filed taxes is ever-changing, and with new legislation and laws being introduced each year, keeping up with Canada’s various tax rules can seem overwhelming when you try and file on your own. For the 2023 tax filing season, several key changes could significantly impact how much you pay in taxes and

15

Nov

Should You Take a Salary or Dividends as a Business Owner?

As a business owner, you have the option of taking a salary or dividends from your company. Both have benefits and drawbacks that you should consider before making a decision. Here’s a breakdown of each option to help you decide which is best for you. The Difference Between a Salary and Dividends A salary is

16

Feb

Tax Deadlines and Tips to Get You Ready for the Upcoming 2020 Tax Season

When the pandemic hit, the Canada Revenue Agency (CRA) adopted measures to help Canadians cope with the global crisis. To do this, they extended both the deadlines for filing taxes and to make any payments that were owed. The CRA also did not charge penalties or interest on tax returns filed by September 1, 2020.

18

Jan

The Canada Emergency Response Benefit and your 2020 Tax Return

Did you receive the Canada Emergency Response Benefit (CERB) during the beginning of the pandemic? If so, you should soon receive your tax slip from the Canada Revenue Agency (CRA) for CERB and any other recovery benefits you may have received in 2020. One thing some people did not seem to realize t is that

15

Apr

Updated: Personal & Corporate Tax Deadlines for 2020 due to COVID-19

With the current financial climate due to the COVID-19 pandemic, the Canada Revenue Agency (CRA) has made some changes to the deadlines of both personal and corporate taxes. If you want to avoid late fees, you need to know when your return and any payments are now due. Here is a list of some important

10

Feb

Save the Date for the Tax Man! Personal Tax Deadlines for 2020

Tax season is here and it can be a stressful time for some. The Canada Revenue Agency (CRA) sets strict filing deadlines and expects to receive your income tax returns and payments on time. If you want to avoid late fees, you need to know when your return and any payments are due. Here is