We’re thrilled to announce a significant milestone at Keenans Accounting Service! Aaron Fecht, a distinguished corporate tax specialist with over nine years of experience at Farm Business Consultants Inc., has acquired our firm. This transition marks a new chapter in our journey to empower businesses in Central Ontario with top-tier accounting expertise. A Warm

10

May

Mid-Year Financial Check-In: Assessing Your Business’s Financial Health in Central Ontario

As we approach the mid-year mark, it’s the perfect time for business owners in Central Ontario to conduct a thorough financial check-up. This mid-year review is crucial for assessing how your business has performed against its financial goals and making necessary adjustments for the remainder of the year. Review Your Financial Goals: Revisit the financial

08

Apr

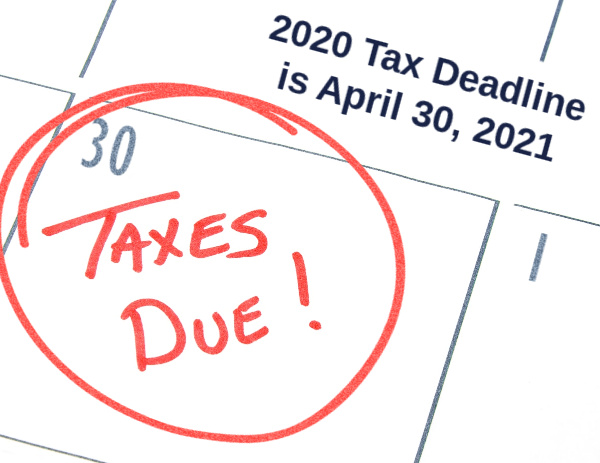

The Consequences of Missing the Canadian Tax Filing Deadline: What You Need to Know

As the tax filing deadline approaches in Canada, it’s crucial for residents of North Simcoe to understand the potential consequences of not filing on time. Navigating the complexities of Canadian tax law can be daunting, but being informed can help you avoid unnecessary penalties and stress. This article explores what can happen if you miss

11

Mar

Spring Cleaning Your Finances: Embracing the New Fiscal Year Ahead

As the seasons change, it’s not just our homes that benefit from a thorough spring cleaning. Our finances, too, deserve a fresh start. For individuals and businesses in Simcoe County and the Southern Georgian Bay area, March is an ideal time to review and refresh financial strategies. It’s important to note that while many companies

13

Nov

Getting Ready For The Holidays: An End-of-Year Bookkeeping Checklist

The holidays are just around the corner, and as a business owner, you’re likely preparing for festivities and well-deserved time off. However, before you dive into the holiday spirit, it’s crucial to ensure that your business finances are in order. A stress-free holiday season starts with a well-organized end-of-year bookkeeping checklist. Compile Your

10

Oct

Weathering the Upcoming Winter Lull: 4 Strategies for Small Businesses

Winter in Simcoe County is a picturesque season, with its pristine snowscapes and cozy charm. However, for the small businesses in the area, it can often be accompanied by a noticeable slowdown in business activity. It’s not all doom and gloom, though, because in this blog we’ll explore four distinct strategies to keep your small

14

Jul

Summer Advice for Small Business Owners: Getting Your Bookkeeping Organized

The summer season is a busy one for business owners throughout Simcoe County, but amidst the chaos of office work and business plans it’s important to take time and organize your bookkeeping. Proper bookkeeping is an essential component of running a successful business, and not having a solid grasp on your financial records can lead

13

Mar

Top 4 Reasons to Outsource Your Business’ Bookkeeping This Spring

As a business owner, you wear many hats. You’re the salesperson, the marketer, the customer service representative, and so much more! During the spring months, it can be tough to juggle everything on your plate while still trying to enjoy some well deserved time off. The best way to ease the stress of being

28

Oct

Top 5 Reasons Why You Should Not Do Your Own Bookkeeping

While we all might think we have a pretty good grasp on how to maintain our personal and business finances, the fact is that bookkeeping is a complex and detail-oriented task that is best left to the professionals. Here are the top five reasons why you shouldn’t do your own bookkeeping. 1. You might make

16

Feb

Tax Deadlines and Tips to Get You Ready for the Upcoming 2020 Tax Season

When the pandemic hit, the Canada Revenue Agency (CRA) adopted measures to help Canadians cope with the global crisis. To do this, they extended both the deadlines for filing taxes and to make any payments that were owed. The CRA also did not charge penalties or interest on tax returns filed by September 1, 2020.