If you’re a small business owner, you may be wondering about the pros and cons of incorporation. Of the few different ways you can structure your business, incorporation has many advantages for small business owners. Read on for some of the key advantages of incorporation to help set your business on the right path. Protection

22

Jul

Should I Hire a Bookkeeper or an Accountant for My Business?

Many entrepreneurs who are just starting out make a similar mistake with their business. Their main focus is to try and save money by doing as much work as possible by themselves. While this might seem like a good idea in the short term, doing your own books could actually be detrimental to your growing

28

Jun

Common Bookkeeping Mistakes Made by Tradespeople

People working in the trades are in very high demand and often busy working long hours to keep up. For some tradespeople, this means that they do not have the time or even energy to sit down after a long day to balance their books, organise the payroll, deal with tax obligations and make their

25

May

How Will the 2021 Budget Affect Me?

With all the excitement of tax season, we didn’t get around to summarizing this year’s Federal Budget. Rest assured that our team is fully updated on all of the latest changes, benefits, credits and more. Find out more about the Government of Canada’s plan to finish the fight against COVID-19 — and ensure a resilient

13

Apr

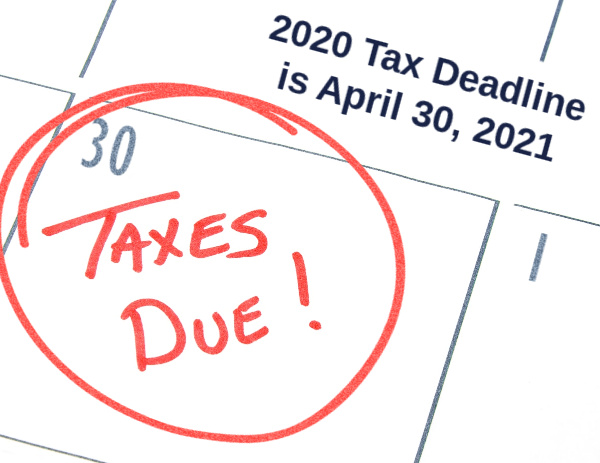

4 Last-Minute Tax Filing Tips

Have you filed your 2020 taxes yet? Or are you one of the many procrastinators that is putting off filing until the last minute? While last year’s tax filing deadline was extended due to the pandemic, this year things are back to normal. This means that you must file your personal income taxes before the

17

Mar

Working from Home Tax Credits

If you collected COVID-19 related benefits last year, you might notice when you do your taxes that you owe much more than in previous years. This is mainly due to CERB payments and some of the earlier benefit payments. These benefits did not have any taxes taken off of them, which means that they must

16

Feb

Tax Deadlines and Tips to Get You Ready for the Upcoming 2020 Tax Season

When the pandemic hit, the Canada Revenue Agency (CRA) adopted measures to help Canadians cope with the global crisis. To do this, they extended both the deadlines for filing taxes and to make any payments that were owed. The CRA also did not charge penalties or interest on tax returns filed by September 1, 2020.

18

Jan

The Canada Emergency Response Benefit and your 2020 Tax Return

Did you receive the Canada Emergency Response Benefit (CERB) during the beginning of the pandemic? If so, you should soon receive your tax slip from the Canada Revenue Agency (CRA) for CERB and any other recovery benefits you may have received in 2020. One thing some people did not seem to realize t is that

17

Dec

COVID-19 Supports for Business

We are now entering one of the hardest seasons for many businesses and the ongoing pandemic is not making it any easier. The effects of COVID-19 are causing many businesses to experience additional financial challenges this holiday season. The Canada Revenue Agency (CRA) has many support benefits available to help business owners stay open during

What Can I Claim On My Taxes When Working From Home During The Pandemic?

Since the beginning of the pandemic, many workforces have shifted from working in an office setting to having employees creating an office at home. This has forced many employees to purchase new furniture and office supplies to continue their job. The question is, can you write off these new expenses on your next tax return?

Recent Comments