As the tax filing deadline approaches in Canada, it’s crucial for residents of North Simcoe to understand the potential consequences of not filing on time. Navigating the complexities of Canadian tax law can be daunting, but being informed can help you avoid unnecessary penalties and stress. This article explores what can happen if you miss

12

Feb

Navigating Tax Season in Ontario: The Advantages of Professional Tax Services

As tax season unfolds in Ontario, individuals and those who are self-employed or running sole proprietorships face the annual task of tax preparation. While the allure of DIY tax software is strong, the benefits of engaging with a professional tax service like Keenans Accounting Service are significant and worth considering. Navigating the Maze of Tax

16

Jan

Maximizing Tax Returns for Small Businesses in Simcoe County

For small businesses in Simcoe County, navigating tax season effectively is not just a compliance requirement; it’s an opportunity to enhance financial health. This guide offers strategic insights into maximizing your tax returns, capitalizing on the unique opportunities and challenges faced by local businesses. Understanding Tax Deductions and Credits: Business Expenses: Dive deeper into

04

Aug

Top 5 Financial Habits of Successful Small Business Owners

As a small business owner, every financial responsibility from managing expenses to tracking revenue streams is yours. However, having a solid financial strategy can help you not only stay afloat but thrive in today’s competitive marketplace. In this blog post, we’ll share the top five financial habits that successful small business owners do to keep

14

Jul

Summer Advice for Small Business Owners: Getting Your Bookkeeping Organized

The summer season is a busy one for business owners throughout Simcoe County, but amidst the chaos of office work and business plans it’s important to take time and organize your bookkeeping. Proper bookkeeping is an essential component of running a successful business, and not having a solid grasp on your financial records can lead

27

Jan

Top 3 Changes To Canada’s Tax System You Need To Know For 2023

The landscape of properly filed taxes is ever-changing, and with new legislation and laws being introduced each year, keeping up with Canada’s various tax rules can seem overwhelming when you try and file on your own. For the 2023 tax filing season, several key changes could significantly impact how much you pay in taxes and

15

Nov

Should You Take a Salary or Dividends as a Business Owner?

As a business owner, you have the option of taking a salary or dividends from your company. Both have benefits and drawbacks that you should consider before making a decision. Here’s a breakdown of each option to help you decide which is best for you. The Difference Between a Salary and Dividends A salary is

20

Oct

When Does My Small Business Need to Start Collecting HST?

As a small business owner, do you know when your business should start collecting HST? The Canadian Revenue Agency (CRA) states that you have to register for an HST account if: You make taxable sales, leases, or other supplies in Canada And you are not a small supplier This could be confusing, especially

Tips to Start and Grow Your Small Business

Congratulations! You have decided to start a new business venture or are planning to grow your existing small business. This can be a daunting task but with the recent pandemic, many people have been moving away from their previous careers and are looking at being their own boss. We have put together some tips to

16

Feb

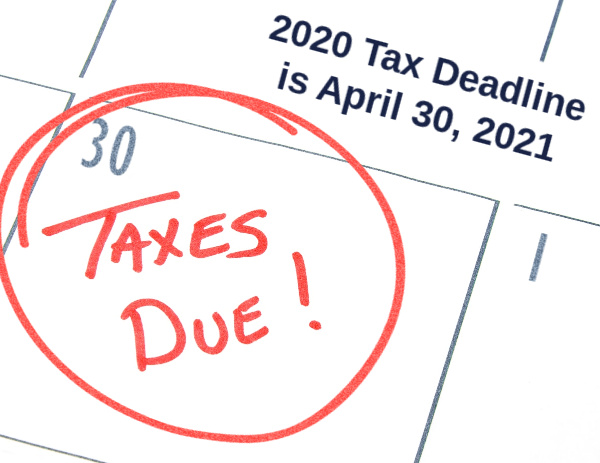

Tax Deadlines and Tips to Get You Ready for the Upcoming 2020 Tax Season

When the pandemic hit, the Canada Revenue Agency (CRA) adopted measures to help Canadians cope with the global crisis. To do this, they extended both the deadlines for filing taxes and to make any payments that were owed. The CRA also did not charge penalties or interest on tax returns filed by September 1, 2020.